Four Ways the CARES Act Can Help Your Business

From loans to tax breaks to credits, the CARES Act attempts to provide relief to small- and medium-sized businesses. As unemployment numbers reach an all-time high, the government is looking for ways to keep Americans employed by helping employers meet payroll.

Section 199A Deduction for Small Business Owners

The United States Internal Revenue Service Has Big Changes for Small Business Owners Two-hundred-forty-seven pages later, we have one large Internal Revenue Service document — and a whole lot of questions about everything from qualified income to 199A QBI deductions. Section 199A dedu …

Financial Planning for Small Business: Questions & Answers

Foundational decisions you make can save you – or cost you – thousands over time, no matter how many widgets you sell or clients you sign up. There are deep structure questions here that will be the difference between long-term growth or flash-in-the-pan success.

COMPLIMENTARY RESOURCE

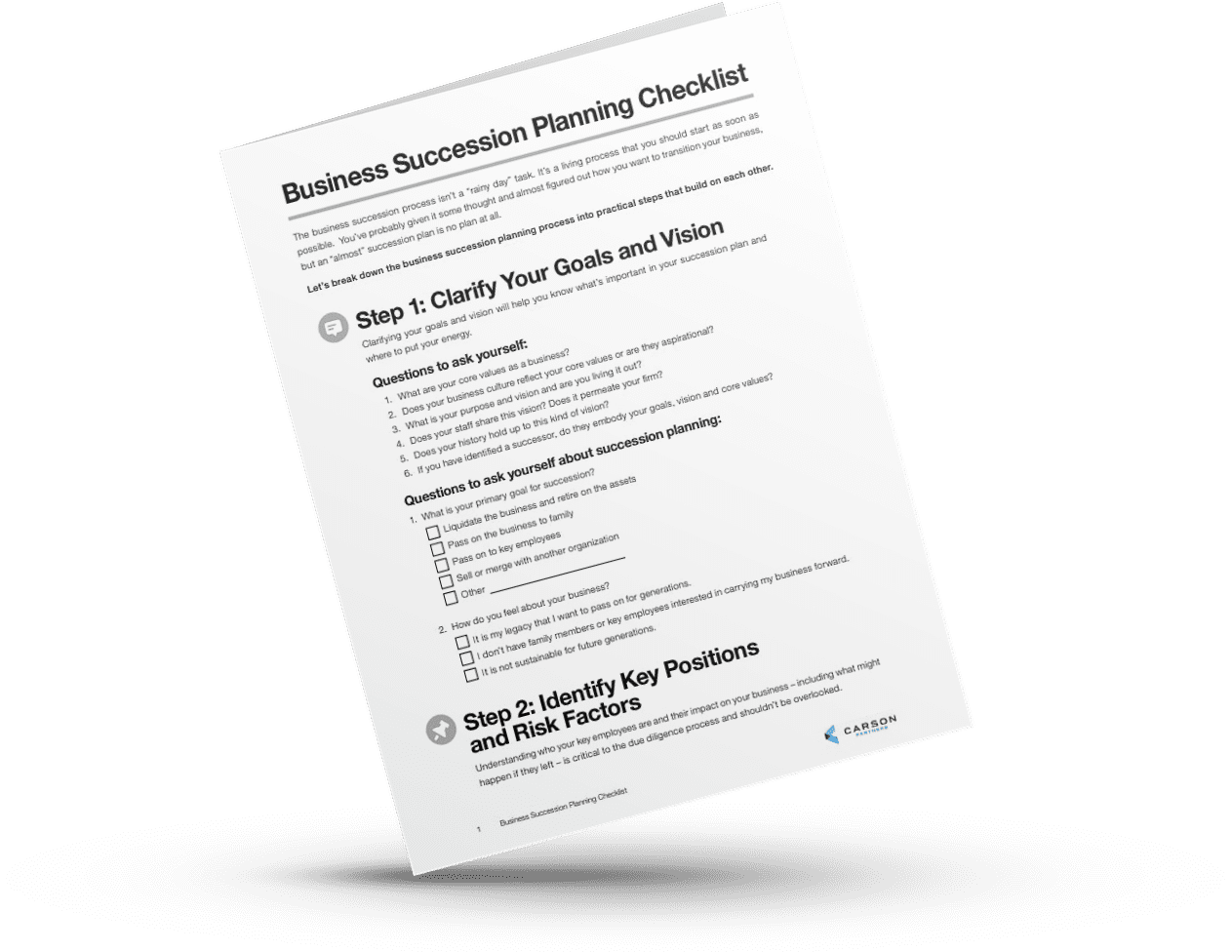

Business Succession Planning Checklist

You remember your first day of business. But what about your last day? Succession planning is more complex than it may seem. Our guide walks you through the details.