When Should I Start Worrying About an Estate Plan?

Who wants to spend an afternoon thinking about their mortality? No one, which is why more than half of Americans don’t even have a will. A will is a legal document that directs:

How Estate and Gift Taxes Can Impact Your Financial Plan

Tom Fridrich, JD, CLU, ChFC®, Manager and Senior Wealth Planner Giving something you own to someone else. It’s a simple, human act – one that seems like it shouldn’t take too much planning to do it correctly. But when does gifting become a tax issue? What do you need to consider about gifti …

Your New Year’s Financial Planning Resolutions

Watch our on-demand webinar, “Your New Year’s Financial Planning Resolutions” with Carson Group’s Retirement Plan Advisor Chris Tooker and Senior Wealth Planner Mark Petersen.

Why You Need a Plan: Strategies for Medicare and Long-Term Care Planning

Watch our on-demand webinar, “Why You Need a Plan: Strategies for Medicare and Long-Term Care Planning” featuring Carson Group’s Vice President, Insurance Matt Lewis and Manager & Senior Wealth Planner Tom Fridrich.

The Benefits & Purpose of a Trust in Estate Planning

By Beth Schanou, JD, CExP, Senior Wealth Planner Clients frequently ask whether they should leave their assets in a trust. My answer: It depends. If your net worth plus the death benefit of life insurance policies you own exceeds $13 million, putting your assets in specific types of trusts …

Why Estate Planning Matters for Everyone

Estate planning may feel like something you don’t have to worry about quite yet. The truth is that ample planning now can make everything easier for your loved ones when the time comes to put an estate plan into action.

Estate Planning Checklist

No matter how few your assets or how extensive your properties, an estate plan will help you preserve your legacy and provide clarity to your surviving family. Our estate planning checklist can help you start the process and tick those important boxes on your way to confidence about the fut …

Why Do I Need a Will? Everything You Need to Know

By Beth Schanou, JD, CExP, Senior Wealth Planner Who wants to spend an afternoon thinking about their mortality? No one, which is why more than half of Americans don’t even have a will.

Life Insurance for Business and Estate Planning

By Matt Lewis, CLTC, Vice President, Insurance Life insurance is designed to provide for your loved ones after your death, giving you peace of mind that their financial needs will be met without your income. But life insurance can benefit your financial planning in many other ways.

Life Goals: Understanding Life Insurance and How it Fits in Your Finances

Watch our webinar, “Life Goals: Understanding Life Insurance and How It Fits in Your Finances” with Carson Group’s Vice President, Insurance Matt Lewis, now available on-demand.

COMPLIMENTARY RESOURCE

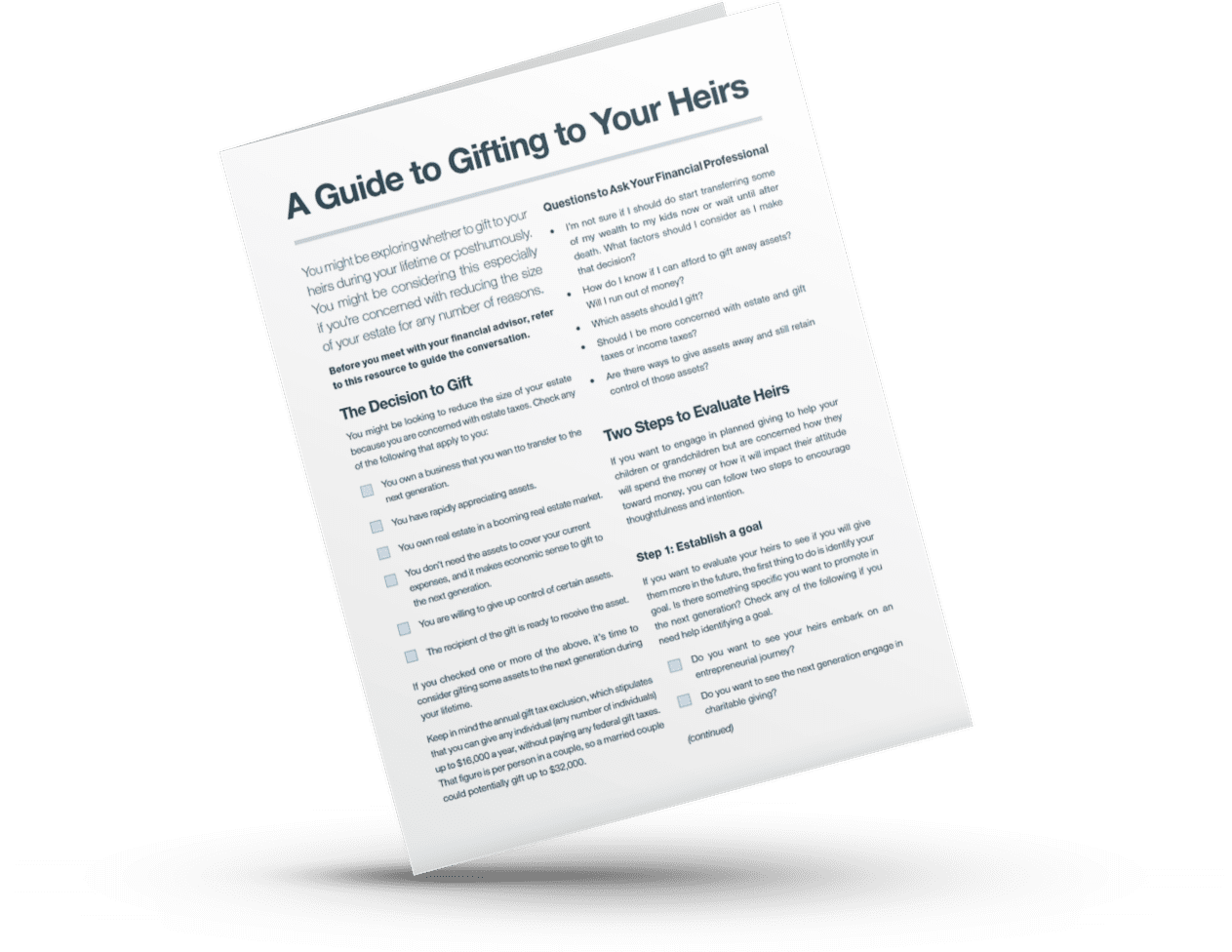

A Guide to Gifting to Your Heirs

Gifting to your loved ones now or posthumously each carries their own positives and negatives as they relate to your estate plan, taxes, your goals and your legacy.