Welcome to Late February

The S&P 500 fell slightly last week, and it’s fair to say the market was due. The shift comes on the heels of the index being higher 14 out of 15 weeks while gaining more than 20% over that period for the first time in history. In other words, a pause is perfectly normal.

- Stocks fell slightly last week, but after the S&P 500 gained more than 20% in 15 weeks, consolidation is to be expected.

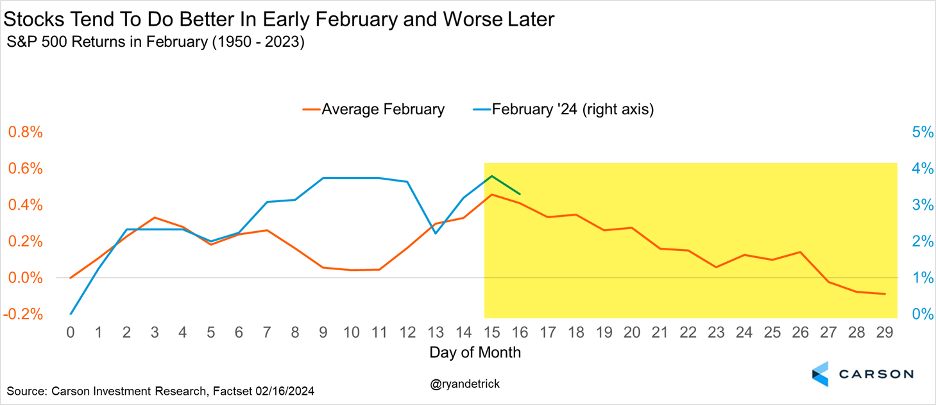

- Historically, late February into mid-March can be troublesome, which increases the odds of a break after the record run.

- Big picture: The bull market is alive and well, and we continue to expect higher prices overall in 2024.

- An upside inflation surprise and a shift in rate-hike expectations contributed to the market’s weakness.

- Given typical early-year inflation volatility and downside pressure suggested by real-time rental data, the strong downward inflation trend will likely continue.

Last week’s weakness was mainly due to declines in large tech and communication services companies, while small- and mid-caps gained on the week. We all know how well the largest tech companies have done over the past year, so potential weakness is noteworthy. But opportunities exist elsewhere, and if the rotation continues, we wouldn’t be surprised to see flows into under-loved areas of the market.

February is historically one of the weaker months of the year, but most of that weakness occurs during the second half of the month. Since the first half of February was strong, weakness over the coming weeks is possible.

The Valentine’s Day Indicator Flashes Green, Not Red

We want to be clear here. Should stocks take a well-deserved break, we still expect higher prices by year end. The economy remains on firm footing overall, and we expect record earnings this year. Profit margins are curling higher, business investment is strong, inflation overall remains in a downtrend, and the Federal Reserve will likely begin cutting rates over the coming months. We were bullish all last year, when many others were forecasting a recession and a bear market. Fortunately, we continue to see many positives overall.

Here’s one more bullish point. The S&P 500 was up more than 4% for the year on Valentine’s Day, which triggered a positive Valentine’s Day Indicator. We found 28 other times stocks were up at least 4% for the year on this day and the rest of the year was quite green — higher 26 times (92.9% of the time) and up more than 13% on average, compared with the average-year gain of 7.5% and higher 73.0% of the time.

January Inflation Came in Hot, But Let’s Calm Down Here

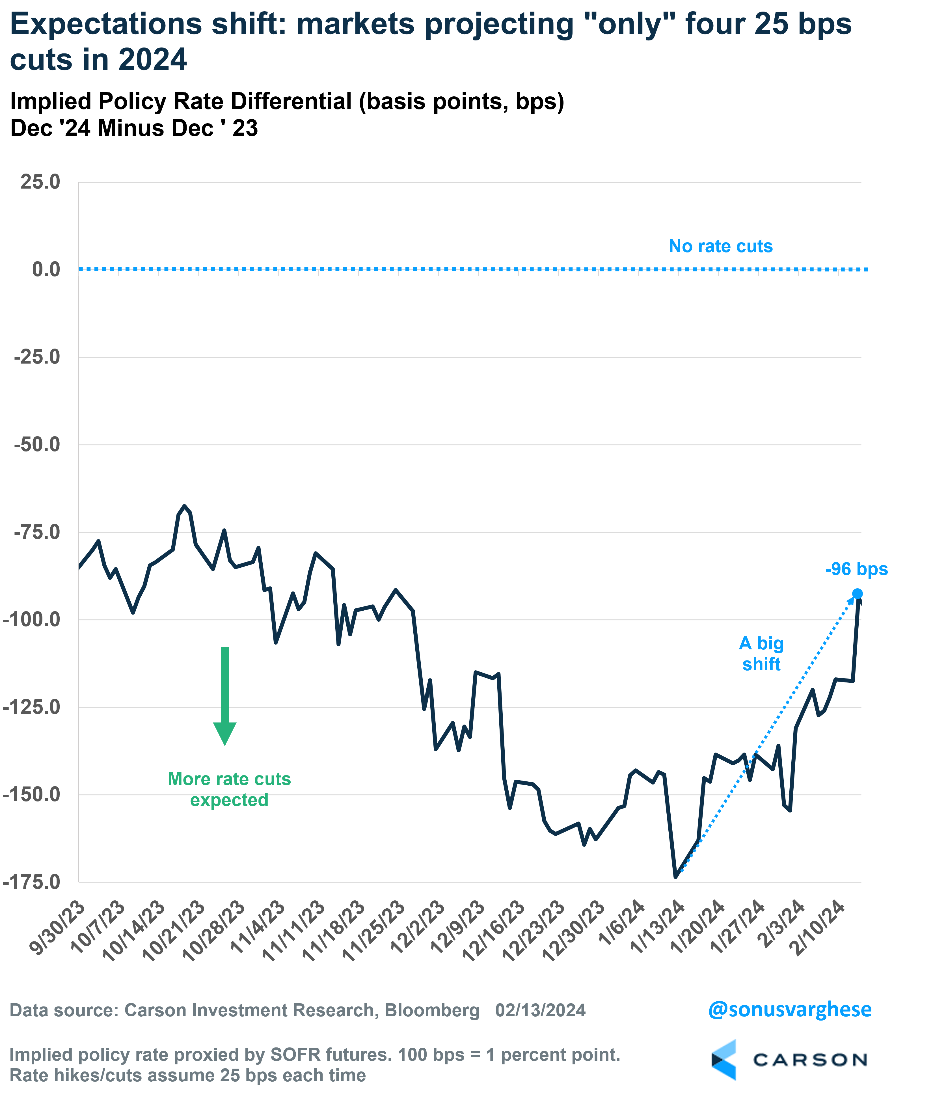

Ouch! That was our reaction to the hotter-than-expected January Consumer Price Index (CPI) report, although that was mild compared to what happened in markets. The S&P 500 fell 1.4% last Tuesday. Bond prices fell as well, with two-year and 10-year Treasury yields jumping 0.14% to 4.63% and 4.31%, respectively. This was on the back of a big shift in the narrative around Federal Reserve rate-cut expectations. The timing of the first cut has been pushed out to June and investors are pricing in about four rate cuts in all of 2024, equivalent to 1%. A month ago, investors believed the first cut would happen in March and the Fed could cut six or seven times in 2024. That’s a big shift in a relatively short period of time, and the January CPI data underlined the move.

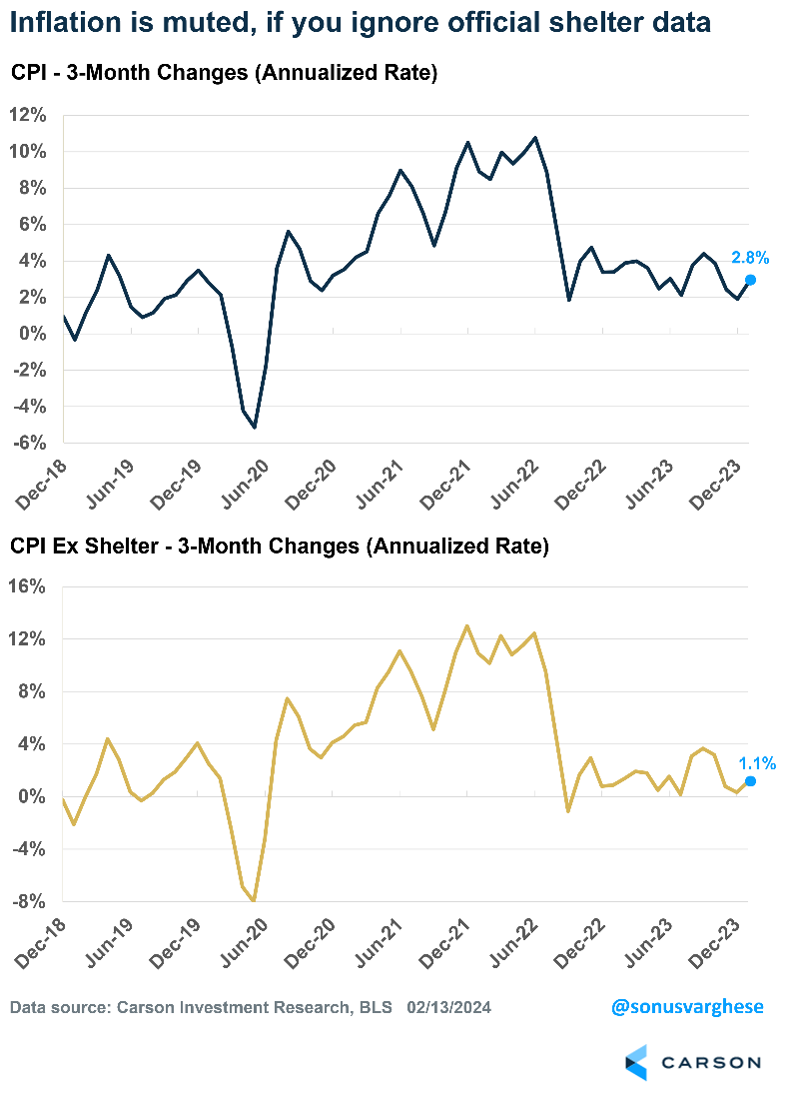

Headline CPI rose 0.3% month over month in January, above expectations for a 0.2% increase. Core CPI, excluding volatile food and energy components, rose 0.4%, above expectations for a 0.3% increase. Over the last three months, headline inflation has been running at a 2.8% annualized rate and core inflation is at 4.0%, well above the Fed’s target of 2%.

Now for the qualifiers, and there are a few.

January is a very volatile month for inflation data, more so when inflation is relatively high. This was the case in 2022 and 2023, when we saw relatively large spikes. This year, expectations were all over the place, reflecting the uncertainty. Seasonal adjustments help, but even those don’t remove the larger-than-normal start-of-the-year price spikes.

CPI inflation is currently elevated mostly because of shelter (housing) inflation. Excluding shelter, headline inflation rose just 0.1% in January. It has run at an annualized pace of 1.1% over the last three months and 2.1% over the last six months. Over the past year, CPI excluding shelter is up just 1.6%.

What’s the Deal with Shelter Inflation?

It would be one thing if official shelter inflation data reflected reality. But it does not. We’ve been writing about this for close to a year and half and talking about it on Facts vs Feelings Take 5.

Shelter inflation within CPI is made up of two components:

- Rents of primary residences, which make up 8% of CPI.

- Owners’ equivalent rent of residences (OER), which make up 27% of CPI. OER is the “implied rent” that homeowners would have to pay if they were renting their homes. It’s as if owners are renting the homes to themselves as a service. The “rents” in OER are determined using equivalent rented homes, and so they essentially track rents. OER has nothing to do with home prices or mortgage rates.

The problem is immediately apparent. Sixty-six percent of American households own their homes, which means the CPI basket (a quarter of which is made up of OER) misrepresents inflation experienced by most households. Keep in mind that the actual “servicing cost” of a home is mostly the mortgage, and the average effective mortgage rate paid by homeowners is about 3.5%.

In short, the large weight of shelter in CPI is a big problem. The Fed focuses on another inflation metric, the Personal Consumption Expenditures Index (PCE), of which shelter makes up just 15%, so the problem is not as big on that side. PCE is running well below CPI as a result.

The other issue with official shelter inflation relates to how it’s measured. Private market data usually tracks only new leases, whereas official data considers both new and existing leases. However, most leases are not up every month and are instead negotiated for longer periods, such as one to two years. This creates a lag between official and actual market data. Another problem is the Bureau of Labor Statistics (BLS) samples units only once in six months, and they smooth price changes over six months. So, rapid shifts in the rental market can take a long time to show up in official data. The lag can be 12-18 months.

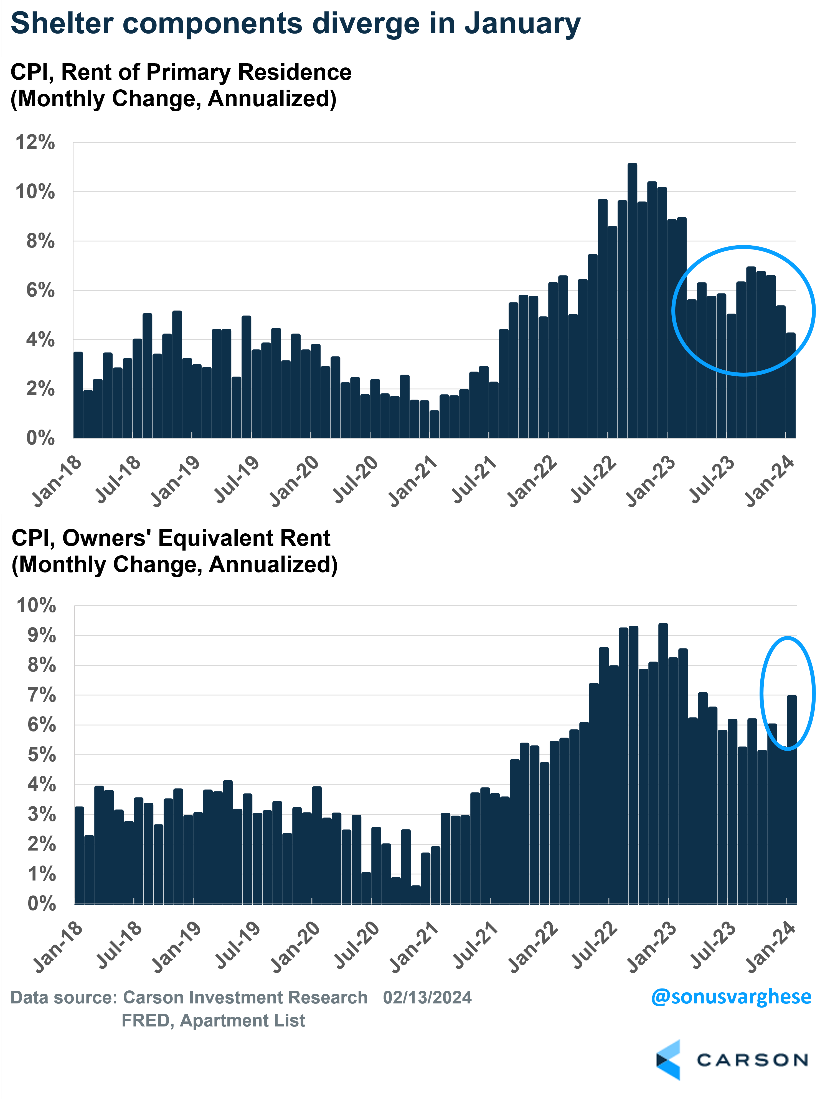

Apartment List’s national rental index has been decelerating since November 2021, and rents have been falling on a year-over-year basis for eight months. Official shelter inflation finally started decelerating last summer, but it’s been agonizingly slow.

January threw a further wrench into the data. Rents rose 0.3% in January, equivalent to an annualized pace of 4.2% — the slowest since September 2021. But OER surged to an annualized pace of 6.9%, the fastest since April 2023. It’s extremely rare for these two to diverge like this, and by itself the rents data is probably more meaningful. In all likelihood, the OER surge is not the start of an upward trend.

How to Make Sense of It All

While disinflation is happening, shelter inflation is keeping CPI elevated. Outside of shelter, services inflation is still relatively high, albeit skewed by “start-of-the-year” January effects. However, this is being offset by falling commodity prices, even outside of energy. Prices for used cars, apparel, household furnishings, and prescription medicines have fallen recently.

A year ago, headline CPI inflation was up 6.4% year over year. That’s now at 3.1%. We’ve made a lot of progress, without a slowdown in economic growth or an increase in unemployment. Nothing we see in other data suggests we’re at the start of an inflation surge. Ultimately, this report is likely to be just a bump in the strong downward inflation trend that began 18 months ago. By mid-2024, barring major surprises, core inflation, especially the Fed’s preferred metric of core PCE, should be very close to the Fed’s target of 2%.

With respect to policy, we still expect rate cuts in 2024. However, absent a recession, we never believed the Fed would cut rates more than four times. That’s where the market is now. Of course, there’s been a sizable shift, but here’s a big positive: The S&P 500 is up 4% year to date despite investors becoming less optimistic about the rate-cut path. Now, there may be some volatility over the next month or two. As my colleague, Ryan Detrick, wrote in a recent blog, February and March are historically weak periods for stocks. The January inflation report may have served as a catalyst right on cue. But at the end of the day, the economy is strong and the stock market has momentum, which means the bull market is likely to continue.

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 – A capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The NASDAQ 100 Index is a stock index of the 100 largest companies by market capitalization traded on NASDAQ Stock Market. The NASDAQ 100 Index includes publicly-traded companies from most sectors in the global economy, the major exception being financial services.

A diversified portfolio does not assure a profit or protect against loss in a declining market.

Compliance Case # 02121983_022024_C